The Privacy.com alternatives are many. Whether it’s for individual or business needs, you’ll find credit cards and wallet solutions that allow you to hide your financial information online.

While Privacy.com has been a popular name, it has erratic policies, weak international currency support, and certain features that put your security at risk.

That’s not the case with the services I’ll show you below:

I’ve compiled the top ten virtual card services known for their ease of setup, privacy regulations, and top-tier security. Let’s dive in!

1. IronVest

IronVest is one of the superior Privacy.com alternatives as it not only masks debit cards and online bank accounts, but also credit cards. All your masked cards and accounts are protected by:

- Bank-grade security software

- A zero-knowledge decentralized architecture

- Decentralized biometric fraud prevention technology

- And biometric 2FA protection

Additionally, you can mask emails, and virtual phone numbers, use biometric 2FA masked autofill profiles to reduce phishing emails, and phone-based attacks, and conduct financial transactions securely. So, IronVest is an all-in-one app with transaction privacy available to all US citizens who have a US credit card and are above 18 years old.

IronVest has three plans: the Essential or free one, the Plus version with single-use masked cards, and the Ultimate version, which has unlimited access to masked cards with bank accounts.

| Pros | Cons |

| Has a browser extension for easy use. | Password storage is local, and it can be lost easily. |

| Great digital anonymity with top-tier biometric protection for cards, accounts, emails, and phone numbers. | The pricing is steep in comparison to Privacy.com or its other alternatives. |

| Ensures your browser activity isn’t tracked, and stops phishing calls. |

2. Ramp

Ramp is one of the Privacy.com alternatives better suited for businesses. It provides masked corporate cards and accounts to businesses of all sizes. There’s no limit on the number of virtual credit cards you can create, or even, the number of physical small business credit cards.

All these masked cards will have automated expense tracking and set limits to ensure your employees or teammates don’t go over the allotted budgets. Ramp also helps you create expense reports and balance sheets to analyze your company’s financial performance.

Moreover, Ramp has an intuitive mobile app for Android and iOS.

| Pros | Cons |

| Great for corporate expense management with unlimited number of virtual and physical masked cards. | Not user-friendly, and involves a steep learning curve. |

| Allows you to analyze expenses and create financial reports. | Technical issues can cause lags. |

| Can capture receipts from Amazon Business and similar eCommerce apps. | Not suited to individuals. |

3. Skrill

Skrill lets you spend money online via masked accounts and prepaid Mastercards. It uses high-level security to ensure all your financial information is protected from prying eyes.

The Skrill Prepaid Card can be reloaded multiple times for speedy contactless payments in stores or online shops. You can’t mask credit cards, using Skrill, however.

But what you can do is money transfers to 40 countries. Skrill also has an iOS and Android app, so you can use it on the go.

If you’re into crypto, you can also use Skrill for crypto purchases. It supports 40 cryptocurrencies like Bitcoin, Ethereum, Dogecoin, and Cardano. Additionally, it has an attractive rewards program that incentivizes you for purchases made via Skrill

| Pros | Cons |

| Fast transfers via masked cards with multi-currency support. | Limited acceptance. |

| Affordable taxes | Customer service could be better. |

| Supports cryptocurrencies | Geographical restrictions in certain countries can make transactions difficult. |

4. Bento for Business

Among Privacy.com alternatives, Bento for Business offers full-featured Visa debit cards to manage your cash. It’s a complete business spending management system you can leverage to set daily limits, restrict certain merchant categories, or create expense track reports.

It uses AI-based receipt capture, making tracking receipts or transactions seamless. You can also export this data to accounting platforms.

For its debit card facilities, you get the level of security and utility benefits that business credit cards provide. With Bento, you enjoy more admin control and rewards in the long run. However, the platform requires you to submit a list of documents for verification, as a part of its onboarding process.

It’s a subsidiary of the U.S. Bank National Association, and its business debit cards provide top-tier protection against fraud or financial scams.

| Pros | Cons |

| Top-tier security and protection. | Not available for sole proprietors or individuals. |

| Offers business debit cards with set limits and more admin control facilities. | Sign-up is time-consuming with a list of required verifications. |

5. Revolut

Revolut is a Privacy.com alternative that’s perfect for both individuals and businesses. It’s a feature-rich platform that offers masked cards and accounts, plus freelance-friendly solutions, and savings accounts with high interest rates.

Revolut has a free sign-up and an intuitive UI. In fact, its card facility is excellent. You can pick an unlimited number of masked cards. Choose physical cards, go virtual, or opt for a combination of both.

You can also link your virtual card to Apple Pay or Google Pay and make instant payments. Moreover, one-use virtual cards are also available. You can set up spending limits to stay within budget, or even freeze your card in a click if you’ve misplaced it.

As for business users, multi-currency accounts, masked cards for employees, international transfers, budget analysis, payment gateways, and saving mechanisms are all available.

| Pros | Cons |

| Unlimited masked cards available for individuals and businesses. | No credit or overdraft options |

| Physical cards can be customized and personalized with metal card options or other aesthetic preferences. | Customer support could be better. |

| Unlimited masked cards are available for individuals and businesses. |

6. Chime

Chime is one of Privacy.com’s alternatives that only works in the U.S. It provides a masked Visa debit card option with no monthly fees or maintenance charges. You can use it across 60,000+ ATMs with transaction alerts that help you control expenses and track them.

You can control the Chime card directly from its app. You can make instant payments through Google Pay, Apple Pay, or similar online wallets. Chime has a nifty where you can round up transactions and transfer the difference to a savings account.

Chime has an overdraft facility, unlike most other Privacy.com alternatives. Also, it doesn’t charge additional fees for international transfers. Signing up is quick and easy.

| Pros | Cons |

| Charges no maintenance or monthly fees for its Visa debit card. | Doesn’t offer masked credit cards. |

| Charges no overdraft or international transfer fees for its masked cards. | The physical card takes 10 days to arrive. |

| Sign-up is quick and easy with instant payment features. |

7. Wise

Wise is a Privacy.com alternative that’s perfect for individuals and businesses looking for a masked virtual card. You can spend online, in stores, and even abroad while saving on currency conversion fees and an extra layer of security.

It’s available in 30+ countries globally, and you can control the card from your phone or laptop. You can also download the Wise app for easier functionality. It supports 40+ currencies, so you’re free to make international multi-currency purchases.

You can have up to three virtual cards at a time. Wise can help you make payments via digital wallets like Google Pay or Apple Pay. The transaction alerts are good and help you keep track of your spending.

| Pros | Cons |

| Offers up to 3 digital cards across 30 countries globally. | Limits and fees are variable and based on your home country. |

| Supports 40+ currencies and also offers a debit card. | Certain international transfers are high. |

| You can withdraw cash in ATMs, and skip hidden transaction fees for international transfers. | Doesn’t offer credit cards. |

8. USU US Unlocked

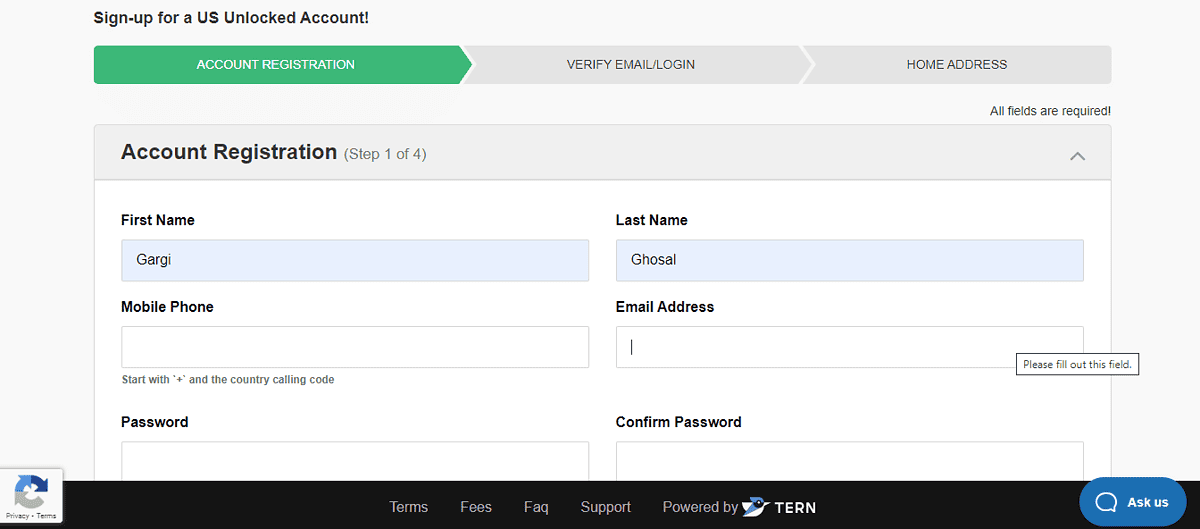

If you’re outside the States, US Unlocked is a great alternative. That’s because you can create multiple masked virtual cards and they all have billing addresses based in the country. You can use them to shop on Amazon, Hulu, Walmart, and similar shops and online stores.

Avoid the hoops of international payments with temporary virtual cards that also support digital wallets like Apple Pay. The platform does charge monthly maintenance, loading, and unloading fees for each transaction.

Setting up an account is easy. Start off with a few personal details, load your account by paying a one-time fee, and then create a card for temporary use or for a specific merchant like Disney+, Netflix, or Amazon.

| Pros | Cons |

| Allows you to create merchant-specific and one-time use masked debit cards. | Has a billing address in the States, so it’s quite useful for people who want to purchase from US online stores. |

| Has a billing address in the Stetes, so it’s quite useful for people who want to purchase from US online stores. | Doesn’t offer or support credit cards. |

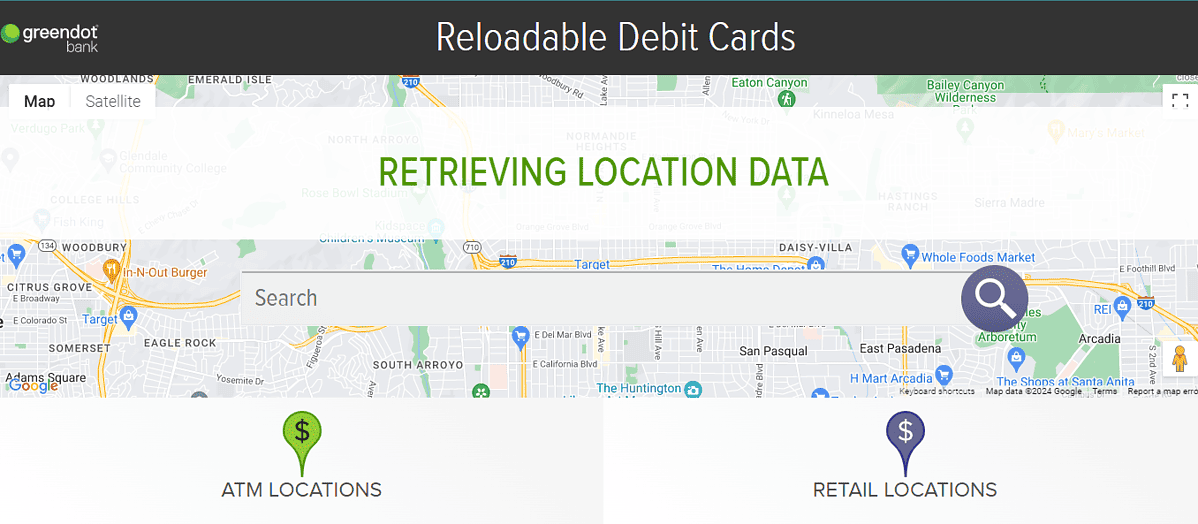

9. Green Dot

Green Dot is a Privacy.com alternative that makes banking easy with its multiple Visa debit card variants, and its special masked temporary option called the Pay As You Go debit card. It’s reloadable and has no monthly maintenance fees. It also allows you to shop online, including from the U.S.

Green Dot adds an extra level of convenience to mobile banking with tracking expenses, account alerts, and chip-enabled account protection.

You can also create virtual accounts with cashback facilities where you can deposit and move money, and pay your bills. Moreover, its MoneyPak feature allows you to send cash quickly and conveniently.

| Pros | Cons |

| Four different cards are available to suit different customers. | Transfers, especially international one, are really slow. |

| Complete banking facilities with digital wallet support. | Steep learning curve with a complex UI. |

10. Neteller

Neteller is a popular Privacy.com alternative that offers the Net+ virtual Mastercard which works like a credit card.

With Neteller, you’ll receive a free card almost instantly. You can pay quickly and track all your transactions in the app. Your bank account details or financial information aren’t released anywhere, so you can rest assured that your personal data is safe.

Neteller operates via an Android and an iOS app. You can also use this platform to buy and sell cryptocurrencies. There’s also a great loyalty program with different levels.

Neteller also has business services. You can open a business account and explore the extent of payment solutions, merchant directories, or quick payouts. Whether affiliate or corporate, you can use Neteller to make payouts that are low-cost, immediate, and easy to do.

| Pros | Cons |

| Supports international money transfer and digital wallet payments. | Doesn’t work for EMIs or multiple installment type payments. |

| Supports cryptocurrency buying and selling, and has loyalty levels. | Transfers can take days. |

Conclusion

Fortunately, there are several Privacy.com alternatives that serve various purposes and also protect your financial data.

For long-term users, Skrill offers transaction rewards, while Neteller features a loyalty program.

Corporate options include Ramp and Bento for Business, whereas Wise, IronVest, and Revolut are perfect for individuals who want customizable cards, top security, and freelancer benefits.